And in Social Security administration legislation Congress named a beneficiary:

Federal Income Taxation

WEvGOV.com

*NOT LEGAL ADVICE! Always have your taxes, and your personal and financial affairs handled by certified / licensed professions.

- Federal income tax enforcement -

Listen: TalkShoe.com/tc/59615 - David R. Myrland on Liberty's Hammer w/Larry Becraft on TheMicroEffect.com 2/14/2015

*US Tax Court review of Pete Hendrickson's "Cracking The Code" Here / My review Here

OID filers - 600+ yrs. in prison Here

"David,

I have read, studied and researched Section 83 in alignment with

your

information. I tried to disprove it, but failed. It is an excellent

work."

Ron

MacDonald (June 7, 2016) Author of "They

Own It All"

"The

taxpayers were entitled to know the basis of law and fact on which

the

Commissioner sought to sustain the deficiencies."

Helvering v. Tex-Penn Oil Co., 300 U.S. 481, 498 (1937).

"But the Internal Revenue Code cannot be so read, for each section is not a self-contained whole,

but rather a building block of a complex, interrelated statute."

Hartman v. C.I.R., 65 T.C. 542 (T.C. 1975); https://casetext.com/case/hartman-v-commissioner-of-internal-revenue-3"By far the most prolific source of research on this topic (the Tax Code) is David Myrland." Sovereignty Education

and Defense Ministry (SEDM.org, Chris Hansen, aka The Family Guardian).

1. Social Security does not apply to Americans:

Tax Code Ch.2 imposes Social Security on self employment income: YouTube - https://youtu.be/bey0EfpKeiQ

26 USC § 1402(b) . . . An individual who is not a citizen of the United States but who is a resident of the Commonwealth of Puerto Rico, the Virgin Islands, Guam, or American Samoa shall not, for the purposes of this chapter be considered to be a nonresident alien individual.

26 CFR 1.1402(b)-1(d) Nonresident aliens. A nonresident alien individual never has self-employment income. While a nonresident alien individual who derives income from a trade or business carried on within the United States, Puerto Rico, the Virgin Islands, Guam, or American Samoa... may be subject to the applicable income tax provisions on such income, such nonresident alien individual will not be subject to the tax on self-employment income, since any net earnings which he may have...do not constitute self-employment income. For the purposes of the tax on self-employment income, an individual who is not a citizen of the United States but who is a resident of the Commonwealth of Puerto Rico, the Virgin Islands, or . . . of Guam or American Samoa is not considered to be a nonresident alien individual.

And in Tax Code chapter 21 FICA, Congress named a subject:

26 USC § 3121(e) An individual who is a citizen of the Commonwealth of Puerto Rico (but not otherwise a citizen of the United States) shall be considered . . . as a citizen of the United States.

26 CFR 31.0-2(a)(1) The terms defined in the provisions of law contained in the regulations in this part shall have the meaning so assigned to them.

26 CFR 31.3121(e)-1(b) ...The term "citizen of the United States" includes a citizen of the Commonwealth of Puerto Rico or the Virgin Islands, and, effective January 1, 1961, a citizen of Guam or American Samoa.

And corporations (employers) are duped as well - matching FICA payments in Ch.21:

26 USC § 3111 - Rate of tax.-

(a) Old-age, survivors, and disability insurance.- In addition to other taxes, there is hereby imposed on every employer an excise tax, with respect to having individuals in his employ, equal to the following percentages of the wages (as defined in section 3121 (a)) paid by him with respect to employment (as defined in section 3121 (b)) -

In cases of wages paid during: The rate shall be:

1984, 1985, 1986, or 1987 5.7 percent

1988 or 1989 6.06 percent

1990 or thereafter 6.2 percent.

(b) Hospital insurance.- In addition to the tax imposed by the preceding subsection, there is hereby imposed on every employer an excise tax, with respect to having individuals in his employ, equal to the following percentages of the wages (as defined in section 3121 (a)) paid by him with respect to employment (as defined in section 3121 (b))—

(1) with respect to wages paid during the calendar years 1974 through 1977, the rate shall be 0.90 percent;

(2) with respect to wages paid during the calendar year 1978, the rate shall be 1.00 percent;

(3) with respect to wages paid during the calendar years 1979 and 1980, the rate shall be 1.05 percent;

(4) with respect to wages paid during the calendar years 1981 through 1984, the rate shall be 1.30 percent;

(5) with respect to wages paid during the calendar year 1985, the rate shall be 1.35 percent; and

(6) with respect to wages paid after December 31, 1985, the rate shall be 1.45 percent.

*"Wages" are wages paid to an employee, who is an individual with the citizenship in 3121(e), above; total of 7.65% matching FICA.

And in Tax Code chapter 23 FUTA (Federal Unemployment Tax Act), Congress named a subject:

26 USC § 3306(j) For purposes of this chapter - An individual who is a citizen of the Commonwealth of Puerto Rico or the Virgin Islands (but not otherwise a citizen of the United States) shall be considered, for purposes of this section, as a citizen of the United States.

26 CFR 31.3306(j)-1 State, United States, and citizen.-

(b) When used in the regulations in this subpart, the term “United States”, when used in a geographical sense, means the several States (including the Territories of Alaska and Hawaii before their admission as States), and the District of Columbia. When used in the regulations in this subpart with respect to remuneration paid after 1960 for services performed after 1960, the term “United States” also includes the Commonwealth of Puerto Rico when the term is used in a geographical sense, and the term “citizen of the United States” includes a citizen of the Commonwealth of Puerto Rico. [T.D. 6658, 28 FR 6641, June 27, 1963]

And in Tax Code chapter 78 subchapter D Possessions:

26 USC § 7655. Cross references.-

(a) Imposition of tax in possessions.- For provisions imposing tax in possessions, see -

(1) Chapter 2, relating to self-employment tax;

(2) Chapter 21, relating to the tax under the Federal Insurance Contributions Act.26 USC § 7651(5) Virgin Islands.-

(A) For purposes of this section, the reference in section 28(a) of the Revised Organic Act of the Virgin Islands to "any tax specified in section 3811 of the Internal Revenue Code" shall be deemed to refer to any tax imposed by chapter 2 or by chapter 21.*Note: Amended in 2007, now at 7651(4)(A), not (5)(A).

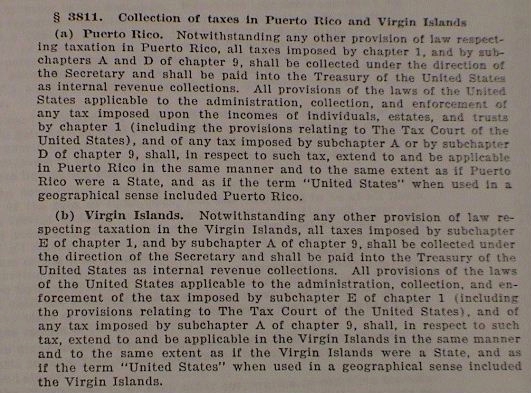

1939 Tax Code § 3811 Collection of Taxes in Puerto Rico and Virgin Islands.

(a) Puerto Rico.

(b) Virgin Islands.

And in Social Security administration legislation Congress named a beneficiary:

42 USC § 411(b)(2) The net earnings from self-employment, if such net earnings for the taxable year are less than $400. An individual who is not a citizen of the United States but who is a resident of the Commonwealth of Puerto Rico, the Virgin Islands, Guam, or American Samoa shall not, for the purpose of this subsection, be considered to be a nonresident alien individual. In the case of church employee income, the special rules of subsection (i)(2) of this section shall apply for purposes of paragraph (2).

Social Security Act of 1935 § 211.- An individual who is not a citizen of the United States but who is a resident of the Commonwealth of Puerto Rico, the Virgin Islands, Guam, or American Samoa shall not, for the purposes of this subsection, be considered to be a nonresident alien individual. In the case of church employee income, the special rules of subsection (i)(2) shall apply for purposes of paragraph (2).

Conclusion: It's clear that Americans have never owed one dime in Social Security or federal unemployment tax. It's extortion committed in a pattern of unlawful conduct; racketeering, conspiracy against rights, mail fraud. With Tax Code chapters 2, 21, and 23 out of the way, the only other chapter of the Tax Code left to deal with is Chapter 1. Read on . . .

§§§§§§§§§§§§§§§§§§§§§§§§§§§§§§§§§§§§§§

2. Tax Code Chapter 1 identifies Americans as subject only in regulation:

In Brown & Williamson v. FDA, 153 F.3d 155, 160-167 (CA4 1998), aff'd 529 U.S. 120 (2000), the 4th Circuit and the Supreme Court rendered very lengthy memorandum opinions in decisions (BOTH in .pdf format here) that stripped the FDA of tobacco enforcement authority, finding that it arose and was founded solely upon regulations promulgated by executive officials. The claim that Americans ("citizens of the United States") are implicated by regulation alone as subject to 26 USC is identical in nature to the claims made against the FDA in that case.

"Finally, the Government points to the fact that the Treasury Regulations relating to the statute purport to include the pick-up man among those subject to the § 3290 tax, and argues (a) that this constitutes an administrative interpretation to which we should give weight in construing the statute, particularly because (b) section 3290 was carried over in haec verba into § 4411 of the Internal Revenue Code of 1954. We find neither argument persuasive. In light of the above discussion, we cannot but regard this Treasury Regulation as no more than an attempted addition to the statute of something which is not there. As such the regulation can furnish no sustenance to the statute. Koshland v. Helvering, 298 U.S. 441, 446-447. Nor is the Government helped by its argument as to the 1954 Code. The regulation had been in effect for only three years, and there is nothing to indicate that it was ever called to the attention of Congress. The re-enactment of § 3290 in the 1954 Code was not accompanied by any congressional discussion which throws light on its intended scope. In such circumstances we consider the 1954 re-enactment to be without significance. Commissioner v. Glenshaw Glass Co., 348 U.S. 426, 431."

See United States v. Calamaro, 354 U.S. 351, 358-39, 77 S.Ct. 1138 (1957). See also, Water Quality Ass'n v. United States, 795 F.2d 1303 (7th Cir. 1986), where, citing and quoting Calamaro, the 7th Circuit Court added at p. 1309:

"It is a basic principle of statutory construction that courts have no right first to determine the legislative intent of a statute and then, under the guise of its interpretation, proceed to either add words to or eliminate other words from the statute's language. DeSoto Securities Co. v. Commissioner, 235 F.2d 409, 411 (7th Cir. 1956); see also 2A Sutherland Statutory Construction § 47.38 (4th Ed. 1984). Similarly, the Secretary has no power to change the language of the revenue statutes because he thinks Congress may have overlooked something."

"But the section contains nothing to that effect, and, therefore, to uphold [IRS Commr's] addition to the tax would be to hold that it may be imposed by regulation, which, of course, the law does not permit. U.S. v. Calamaro, 354 US 351, 359; Koshland v. Helvering, 298 US 441, 446-67; Manhattan Equipment Co. v. Commissioner, 297 US 129, 134."

Tax Code chapter 1 income taxes on compensation for services and on capital gains is said to be imposed by § 1, where we find married individuals, heads of households, suviving spouses, single individuals, and others. HOWEVER, we will find no reference whatsoever to any particular citizenship:

26

U.S. Code § 1 - Tax imposed

(a) Married

individuals filing joint returns and surviving spouses.- There is hereby

imposed on the taxable income of—

(1) every married

individual (as defined in section 7703) who makes a single return jointly

with his spouse under section 6013, and

(2) every surviving

spouse (as defined in section 2 (a)), a tax determined in accordance with

the following table:

If taxable income is: The tax is:

Not over $36,900 15% of taxable income.

Over $36,900 but not over $89,150 $5,535, plus 28% of the excess over $36,900.

Over $89,150 but not over $140,000 $20,165, plus 31% of the excess over $89,150.

Over $140,000 but not over $250,000 $35,928.50, plus 36% of the excess over $140,000.

Over $250,000 $75,528.50, plus 39.6% of the excess over $250,000.(b) Heads of households

There is hereby imposed on the taxable income of every head of a household (as defined in section 2 (b)) a tax determined in accordance with the following table:If taxable income is: The tax is:

Not over $29,600 15% of taxable income.

Over $29,600 but not over $76,400 $4,440, plus 28% of the excess over $29,600.

Over $76,400 but not over $127,500 $17,544, plus 31% of the excess over $76,400.

Over $127,500 but not over $250,000 $33,385, plus 36% of the excess over $127,500.

Over $250,000 $77,485, plus 39.6% of the excess over $250,000.(c) Unmarried individuals (other than surviving spouses and heads of households)

There is hereby imposed on the taxable income of every individual (other than a surviving spouse as defined in section 2 (a) or the head of a household as defined in section 2 (b)) who is not a married individual (as defined in section 7703) a tax determined in accordance with the following table:

If taxable income is: The tax is:

Not over $22,100 15% of taxable income.

Over $22,100 but not over $53,500 $3,315, plus 28% of the excess over $22,100.

Over $53,500 but not over $115,000 $12,107, plus 31% of the excess over $53,500.

Over $115,000 but not over $250,000 $31,172, plus 36% of the excess over $115,000.

Over $250,000 $79,772, plus 39.6% of the excess over $250,000.(d) Married individuals filing separate returns

There is hereby imposed on the taxable income of every married individual (as defined in section 7703) who does not make a single return jointly with his spouse under section 6013, a tax determined in accordance with the following table:

If taxable income is: The tax is:

Not over $18,450 15% of taxable income.

Over $18,450 but not over $44,575 $2,767.50, plus 28% of the excess over $18,450.

Over $44,575 but not over $70,000 $10,082.50, plus 31% of the excess over $44,575.

Over $70,000 but not over $125,000 $17,964.25, plus 36% of the excess over $70,000.

Over $125,000 $37,764.25, plus 39.6% of the excess over $125,000.(e) Estates and trusts

There is hereby imposed on the taxable income of—

(1) every estate, and

(2) every trust,

taxable under this subsection a tax determined in accordance with the following table:If taxable income is: The tax is:

Not over $1,500 15% of taxable income.

Over $1,500 but not over $3,500 $225, plus 28% of the excess over $1,500.

Over $3,500 but not over $5,500 $785, plus 31% of the excess over $3,500.

Over $5,500 but not over $7,500 $1,405, plus 36% of the excess over $5,500.

Over $7,500 $2,125, plus 39.6% of the excess over $7,500.(f) Phaseout of marriage penalty in 15-percent bracket; adjustments in tax tables so that inflation will not result in tax increases

(1) In general

Not later than December 15 of 1993, and each subsequent calendar year, the Secretary shall prescribe tables which shall apply in lieu of the tables contained in subsections (a), (b), (c), (d), and (e) with respect to taxable years beginning in the succeeding calendar year.

(2) Method of prescribing tables

The table which under paragraph (1) is to apply in lieu of the table contained in subsection (a), (b), (c), (d), or (e), as the case may be, with respect to taxable years beginning in any calendar year shall be prescribed—

(A) except as provided in paragraph (8), by increasing the minimum and maximum dollar amounts for each rate bracket for which a tax is imposed under such table by the cost-of-living adjustment for such calendar year,

(B) by not changing the rate applicable to any rate bracket as adjusted under subparagraph (A), and

(C) by adjusting the amounts setting forth the tax to the extent necessary to reflect the adjustments in the rate brackets.

(3) Cost-of-living adjustment

For purposes of paragraph (2), the cost-of-living adjustment for any calendar year is the percentage (if any) by which—

(A) the CPI for the preceding calendar year, exceeds

(B) the CPI for the calendar year 1992.

(4) CPI for any calendar year

For purposes of paragraph (3), the CPI for any calendar year is the average of the Consumer Price Index as of the close of the 12-month period ending on August 31 of such calendar year.

(5) Consumer Price Index

For purposes of paragraph (4), the term “Consumer Price Index” means the last Consumer Price Index for all-urban consumers published by the Department of Labor. For purposes of the preceding sentence, the revision of the Consumer Price Index which is most consistent with the Consumer Price Index for calendar year 1986 shall be used.

(6) Rounding

(A) In general

If any increase determined under paragraph (2)(A), section 63 (c)(4), section 68(b)(2) or section 151 (d)(4) is not a multiple of $50, such increase shall be rounded to the next lowest multiple of $50.

(B) Table for married individuals filing separately

In the case of a married individual filing a separate return, subparagraph (A) (other than with respect to sections 63 (c)(4) and 151 (d)(4)(A)) shall be applied by substituting “$25” for “$50” each place it appears.

(7) Special rule for certain brackets

(A) Calendar year 1994

In prescribing the tables under paragraph (1) which apply with respect to taxable years beginning in calendar year 1994, the Secretary shall make no adjustment to the dollar amounts at which the 36 percent rate bracket begins or at which the 39.6 percent rate begins under any table contained in subsection (a), (b), (c), (d), or (e).

(B) Later calendar years

In prescribing tables under paragraph (1) which apply with respect to taxable years beginning in a calendar year after 1994, the cost-of-living adjustment used in making adjustments to the dollar amounts referred to in subparagraph (A) shall be determined under paragraph (3) by substituting “1993” for “1992”.

(8) Elimination of marriage penalty in 15-percent bracket

With respect to taxable years beginning after December 31, 2003, in prescribing the tables under paragraph (1)—

(A) the maximum taxable income in the 15-percent rate bracket in the table contained in subsection (a) (and the minimum taxable income in the next higher taxable income bracket in such table) shall be 200 percent of the maximum taxable income in the 15-percent rate bracket in the table contained in subsection (c) (after any other adjustment under this subsection), and

(B) the comparable taxable income amounts in the table contained in subsection (d) shall be 1/2 of the amounts determined under subparagraph (A).

(g) Certain unearned income of children taxed as if parent’s income

(1) In general

In the case of any child to whom this subsection applies, the tax imposed by this section shall be equal to the greater of—

(A) the tax imposed by this section without regard to this subsection, or

(B) the sum of—

(i) the tax which would be imposed by this section if the taxable income of such child for the taxable year were reduced by the net unearned income of such child, plus

(ii) such child’s share of the allocable parental tax.

(2) Child to whom subsection applies

This subsection shall apply to any child for any taxable year if—

(A) such child—

(i) has not attained age 18 before the close of the taxable year, or

(ii)

(I) has attained age 18 before the close of the taxable year and meets the age requirements of section 152 (c)(3) (determined without regard to subparagraph (B) thereof), and

(II) whose earned income (as defined in section 911 (d)(2)) for such taxable year does not exceed one-half of the amount of the individual’s support (within the meaning of section 152 (c)(1)(D) after the application of section 152 (f)(5) (without regard to subparagraph (A) thereof)) for such taxable year,

(B) either parent of such child is alive at the close of the taxable year, and

(C) such child does not file a joint return for the taxable year.

(3) Allocable parental tax

For purposes of this subsection—

(A) In general

The term “allocable parental tax” means the excess of—

(i) the tax which would be imposed by this section on the parent’s taxable income if such income included the net unearned income of all children of the parent to whom this subsection applies, over

(ii) the tax imposed by this section on the parent without regard to this subsection.

For purposes of clause (i), net unearned income of all children of the parent shall not be taken into account in computing any exclusion, deduction, or credit of the parent.

(B) Child’s share

A child’s share of any allocable parental tax of a parent shall be equal to an amount which bears the same ratio to the total allocable parental tax as the child’s net unearned income bears to the aggregate net unearned income of all children of such parent to whom this subsection applies.

(C) Special rule where parent has different taxable year

Except as provided in regulations, if the parent does not have the same taxable year as the child, the allocable parental tax shall be determined on the basis of the taxable year of the parent ending in the child’s taxable year.

(4) Net unearned income

For purposes of this subsection—

(A) In general

The term “net unearned income” means the excess of—

(i) the portion of the adjusted gross income for the taxable year which is not attributable to earned income (as defined in section 911 (d)(2)), over

(ii) the sum of—

(I) the amount in effect for the taxable year under section 63 (c)(5)(A) (relating to limitation on standard deduction in the case of certain dependents), plus

(II) the greater of the amount described in subclause (I) or, if the child itemizes his deductions for the taxable year, the amount of the itemized deductions allowed by this chapter for the taxable year which are directly connected with the production of the portion of adjusted gross income referred to in clause (i).

(B) Limitation based on taxable income

The amount of the net unearned income for any taxable year shall not exceed the individual’s taxable income for such taxable year.

(C) Treatment of distributions from qualified disability trusts

For purposes of this subsection, in the case of any child who is a beneficiary of a qualified disability trust (as defined in section 642 (b)(2)(C)(ii)), any amount included in the income of such child under sections 652 and 662 during a taxable year shall be considered earned income of such child for such taxable year.

(5) Special rules for determining parent to whom subsection applies

For purposes of this subsection, the parent whose taxable income shall be taken into account shall be—

(A) in the case of parents who are not married (within the meaning of section 7703), the custodial parent (within the meaning of section 152(e)) of the child, and

(B) in the case of married individuals filing separately, the individual with the greater taxable income.

(6) Providing of parent’s TIN

The parent of any child to whom this subsection applies for any taxable year shall provide the TIN of such parent to such child and such child shall include such TIN on the child’s return of tax imposed by this section for such taxable year.

(7) Election to claim certain unearned income of child on parent’s return

(A) In general

If—

(i) any child to whom this subsection applies has gross income for the taxable year only from interest and dividends (including Alaska Permanent Fund dividends),

(ii) such gross income is more than the amount described in paragraph (4)(A)(ii)(I) and less than 10 times the amount so described,

(iii) no estimated tax payments for such year are made in the name and TIN of such child, and no amount has been deducted and withheld under section 3406, and

(iv) the parent of such child (as determined under paragraph (5)) elects the application of subparagraph (B),

such child shall be treated (other than for purposes of this paragraph) as having no gross income for such year and shall not be required to file a return under section 6012.

(B) Income included on parent’s return

In the case of a parent making the election under this paragraph—

(i) the gross income of each child to whom such election applies (to the extent the gross income of such child exceeds twice the amount described in paragraph (4)(A)(ii)(I)) shall be included in such parent’s gross income for the taxable year,

(ii) the tax imposed by this section for such year with respect to such parent shall be the amount equal to the sum of—

(I) the amount determined under this section after the application of clause (i), plus

(II) for each such child, 10 percent of the lesser of the amount described in paragraph (4)(A)(ii)(I) or the excess of the gross income of such child over the amount so described, and

(iii) any interest which is an item of tax preference under section 57(a)(5) of the child shall be treated as an item of tax preference of such parent (and not of such child).

(C) Regulations

The Secretary shall prescribe such regulations as may be necessary or appropriate to carry out the purposes of this paragraph.

(h) Maximum capital gains rate

(1) In general.- If a taxpayer has a net capital gain for any taxable year, the tax imposed by this section for such taxable year shall not exceed the sum of—

(A) a tax computed at the rates and in the same manner as if this subsection had not been enacted on the greater of—

(i) taxable income reduced by the net capital gain; or

(ii) the lesser of—

(I) the amount of taxable income taxed at a rate below 25 percent; or

(II) taxable income reduced by the adjusted net capital gain;

(B) 0 percent of so much of the adjusted net capital gain (or, if less, taxable income) as does not exceed the excess (if any) of—

(i) the amount of taxable income which would (without regard to this paragraph) be taxed at a rate below 25 percent, over

(ii) the taxable income reduced by the adjusted net capital gain;

(C) 15 percent of the lesser of—

(i) so much of the adjusted net capital gain (or, if less, taxable income) as exceeds the amount on which a tax is determined under subparagraph (B), or

(ii) the excess of—

(I) the amount of taxable income which would (without regard to this paragraph) be taxed at a rate below 39.6 percent, over

(II) the sum of the amounts on which a tax is determined under subparagraphs (A) and (B),

(D) 20 percent of the adjusted net capital gain (or, if less, taxable income) in excess of the sum of the amounts on which tax is determined under subparagraphs (B) and (C),

(E) 25 percent of the excess (if any) of—

(i) the unrecaptured section 1250 gain (or, if less, the net capital gain (determined without regard to paragraph (11))), over

(ii) the excess (if any) of—

(I) the sum of the amount on which tax is determined under subparagraph (A) plus the net capital gain, over

(II) taxable income; and

(F) 28 percent of the amount of taxable income in excess of the sum of the amounts on which tax is determined under the preceding subparagraphs of this paragraph.

(2) Net capital gain taken into account as investment income

For purposes of this subsection, the net capital gain for any taxable year shall be reduced (but not below zero) by the amount which the taxpayer takes into account as investment income under section 163 (d)(4)(B)(iii).

(3) Adjusted net capital gain

For purposes of this subsection, the term “adjusted net capital gain” means the sum of—

(A) net capital gain (determined without regard to paragraph (11)) reduced (but not below zero) by the sum of—

(i) unrecaptured section 1250 gain, and

(ii) 28-percent rate gain, plus

(B) qualified dividend income (as defined in paragraph (11)).

(4) 28-percent rate gain

For purposes of this subsection, the term “28-percent rate gain” means the excess (if any) of—

(A) the sum of—

(i) collectibles gain; and

(ii) section 1202 gain, over

(B) the sum of—

(i) collectibles loss;

(ii) the net short-term capital loss; and

(iii) the amount of long-term capital loss carried under section 1212 (b)(1)(B) to the taxable year.

(5) Collectibles gain and loss

For purposes of this subsection—

(A) In general

The terms “collectibles gain” and “collectibles loss” mean gain or loss (respectively) from the sale or exchange of a collectible (as defined in section 408 (m) without regard to paragraph (3) thereof) which is a capital asset held for more than 1 year but only to the extent such gain is taken into account in computing gross income and such loss is taken into account in computing taxable income.

(B) Partnerships, etc.

For purposes of subparagraph (A), any gain from the sale of an interest in a partnership, S corporation, or trust which is attributable to unrealized appreciation in the value of collectibles shall be treated as gain from the sale or exchange of a collectible. Rules similar to the rules of section 751 shall apply for purposes of the preceding sentence.

(6) Unrecaptured section 1250 gain

For purposes of this subsection—

(A) In general

The term “unrecaptured section 1250 gain” means the excess (if any) of—

(i) the amount of long-term capital gain (not otherwise treated as ordinary income) which would be treated as ordinary income if section 1250 (b)(1) included all depreciation and the applicable percentage under section 1250 (a) were 100 percent, over

(ii) the excess (if any) of—

(I) the amount described in paragraph (4)(B); over

(II) the amount described in paragraph (4)(A).

(B) Limitation with respect to section 1231 property

The amount described in subparagraph (A)(i) from sales, exchanges, and conversions described in section 1231 (a)(3)(A) for any taxable year shall not exceed the net section 1231 gain (as defined in section 1231 (c)(3)) for such year.

(7) Section 1202 gain

For purposes of this subsection, the term “section 1202 gain” means the excess of—

(A) the gain which would be excluded from gross income under section 1202 but for the percentage limitation in section 1202 (a), over

(B) the gain excluded from gross income under section 1202.

(8) Coordination with recapture of net ordinary losses under section 1231

If any amount is treated as ordinary income under section 1231 (c), such amount shall be allocated among the separate categories of net section 1231 gain (as defined in section 1231 (c)(3)) in such manner as the Secretary may by forms or regulations prescribe.

(9) Regulations

The Secretary may prescribe such regulations as are appropriate (including regulations requiring reporting) to apply this subsection in the case of sales and exchanges by pass-thru entities and of interests in such entities.

(10) Pass-thru entity defined

For purposes of this subsection, the term “pass-thru entity” means—

(A) a regulated investment company;

(B) a real estate investment trust;

(C) an S corporation;

(D) a partnership;

(E) an estate or trust;

(F) a common trust fund; and

(G) a qualified electing fund (as defined in section 1295).

(11) Dividends taxed as net capital gain

(A) In general

For purposes of this subsection, the term “net capital gain” means net capital gain (determined without regard to this paragraph) increased by qualified dividend income.

(B) Qualified dividend income

For purposes of this paragraph—

(i) In general The term “qualified dividend income” means dividends received during the taxable year from—

(I) domestic corporations, and

(II) qualified foreign corporations.

(ii) Certain dividends excluded Such term shall not include—

(I) any dividend from a corporation which for the taxable year of the corporation in which the distribution is made, or the preceding taxable year, is a corporation exempt from tax under section 501 or 521,

(II) any amount allowed as a deduction under section 591 (relating to deduction for dividends paid by mutual savings banks, etc.), and

(III) any dividend described in section 404 (k).

(iii) Coordination with section 246 (c) Such term shall not include any dividend on any share of stock—

(I) with respect to which the holding period requirements of section 246 (c) are not met (determined by substituting in section 246 (c) “60 days” for “45 days” each place it appears and by substituting “121-day period” for “91-day period”), or

(II) to the extent that the taxpayer is under an obligation (whether pursuant to a short sale or otherwise) to make related payments with respect to positions in substantially similar or related property.

(C) Qualified foreign corporations

(i) In general Except as otherwise provided in this paragraph, the term “qualified foreign corporation” means any foreign corporation if—

(I) such corporation is incorporated in a possession of the United States, or

(II) such corporation is eligible for benefits of a comprehensive income tax treaty with the United States which the Secretary determines is satisfactory for purposes of this paragraph and which includes an exchange of information program.

(ii) Dividends on stock readily tradable on United States securities market A foreign corporation not otherwise treated as a qualified foreign corporation under clause (i) shall be so treated with respect to any dividend paid by such corporation if the stock with respect to which such dividend is paid is readily tradable on an established securities market in the United States.

(iii) Exclusion of dividends of certain foreign corporations Such term shall not include any foreign corporation which for the taxable year of the corporation in which the dividend was paid, or the preceding taxable year, is a passive foreign investment company (as defined in section 1297).

(iv) Coordination with foreign tax credit limitation Rules similar to the rules of section 904 (b)(2)(B) shall apply with respect to the dividend rate differential under this paragraph.

(D) Special rules

(i) Amounts taken into account as investment income Qualified dividend income shall not include any amount which the taxpayer takes into account as investment income under section 163 (d)(4)(B).

(ii) Extraordinary dividends If a taxpayer to whom this section applies receives, with respect to any share of stock, qualified dividend income from 1 or more dividends which are extraordinary dividends (within the meaning of section 1059 (c)), any loss on the sale or exchange of such share shall, to the extent of such dividends, be treated as long-term capital loss.

(iii) Treatment of dividends from regulated investment companies and real estate investment trusts A dividend received from a regulated investment company or a real estate investment trust shall be subject to the limitations prescribed in sections 854 and 857.

(i) Rate reductions after 2000

(1) 10-percent rate bracket

(A) In general

In the case of taxable years beginning after December 31, 2000—

(i) the rate of tax under subsections (a), (b), (c), and (d) on taxable income not over the initial bracket amount shall be 10 percent, and

(ii) the 15 percent rate of tax shall apply only to taxable income over the initial bracket amount but not over the maximum dollar amount for the 15-percent rate bracket.

(B) Initial bracket amount

For purposes of this paragraph, the initial bracket amount is—

(i) $14,000 in the case of subsection (a),

(ii) $10,000 in the case of subsection (b), and

(iii) 1/2 the amount applicable under clause (i) (after adjustment, if any, under subparagraph (C)) in the case of subsections (c) and (d).

(C) Inflation adjustment

In prescribing the tables under subsection (f) which apply with respect to taxable years beginning in calendar years after 2003—

(i) the cost-of-living adjustment shall be determined under subsection (f)(3) by substituting “2002” for “1992” in subparagraph (B) thereof, and

(ii) the adjustments under clause (i) shall not apply to the amount referred to in subparagraph (B)(iii).

If any amount after adjustment under the preceding sentence is not a multiple of $50, such amount shall be rounded to the next lowest multiple of $50.

(2) 25-, 28-, and 33-percent rate brackets

The tables under subsections (a), (b), (c), (d), and (e) shall be applied—

(A) by substituting “25%” for “28%” each place it appears (before the application of subparagraph (B)),

(B) by substituting “28%” for “31%” each place it appears, and

(C) by substituting “33%” for “36%” each place it appears.

(3) Modifications to income tax brackets for high-income taxpayers

(A) 35-percent rate bracket

In the case of taxable years beginning after December 31, 2012—

(i) the rate of tax under subsections (a), (b), (c), and (d) on a taxpayer’s taxable income in the highest rate bracket shall be 35 percent to the extent such income does not exceed an amount equal to the excess of—

(I) the applicable threshold, over

(II) the dollar amount at which such bracket begins, and

(ii) the 39.6 percent rate of tax under such subsections shall apply only to the taxpayer’s taxable income in such bracket in excess of the amount to which clause (i) applies.

(B) Applicable threshold

For purposes of this paragraph, the term “applicable threshold” means—

(i) $450,000 in the case of subsection (a),

(ii) $425,000 in the case of subsection (b),

(iii) $400,000 in the case of subsection (c), and

(iv) 1/2 the amount applicable under clause (i) (after adjustment, if any, under subparagraph (C)) in the case of subsection (d).

(C) Inflation adjustment

For purposes of this paragraph, with respect to taxable years beginning in calendar years after 2013, each of the dollar amounts under clauses (i), (ii), and (iii) of subparagraph (B) shall be adjusted in the same manner as under paragraph (1)(C)(i), except that subsection (f)(3)(B) shall be applied by substituting “2012” for “1992”.

(4) Adjustment of tables

The Secretary shall adjust the tables prescribed under subsection (f) to carry out this subsection.

And here's the regulation that's supposed to "explain" or otherwise bring into law the statute above, Tax Code § 1:

26 CFR 1.1-1 Income tax on individuals.

(a) General rule.

(1) Section 1 of the Code imposes an income tax on the income of every individual who is a citizen or resident of the United States.

(b) Citizens of the United States or residents liable to tax. In general, all citizens of the United States, wherever resident, and all resident alien individual are liable to the income taxes imposed by the Code whether the income is received from sources within or without the United States.

(c) Who is a citizen. Every person born or naturalized in the United States and subject to its jurisdiction is a citizen.

And here's the case law (40 decisions) which clearly draws upon the regulation to implicate Americans, while the statute said nothing of the sort:

"CA" means Court of Appeals, "CA1" would mean 1st Circuit Court of Appeals.

CA 1:

Metallic v. Commissioner of Internal Revenue, 225 Fed.Appx. 1, 99 A.F.T.R.2d (RIA) 3033 (CA1 2007); "Metallic acknowledges that he resides in this country, and so the tax laws apply to him even if he is not a citizen. See, e.g., 26 CFR § 1.1-1(a)(1) (noting that the tax code imposes a tax on the income of "every individual who is a citizen or resident of the United States").

US v. Benitez Rexach, 411 F.Supp. 1288, 1291 (US Dist. Court 1st Cir. 1975): "The tax regulations of the United States generally provide that citizens of the United States (fn.7) are liable to pay income tax even if they are not residents of the United States and own no assets or receive no income within the United States. (fn.8) See 26 CFR § 1.1-1(a)(1), P-H 1975 Fed. Taxes Sec. 3423; Cook v. Tait, 265 US 47, 68 L.Ed. 895, 44 S.Ct. 444 (1924); U.S. v. Benitez Rexach, 185 F.Supp. 465 (D.C.P.R. 1960). A citizen is defined by the regulations as a person born or naturalized in the United States and who is subject to its jurisdiction. Such a definition must be made under the Immigration and Naturalization Act of 1954. See P-H 1975 Fed. Taxes Sec. 3424."

Rowe v. Internal Revenue Service, 97 A.F.T.R.2d (RIA) 2422 (Dist. Court 1st Cir. 2006), quoting IRS' memorandum: "Despite Rowe's attempt to avoid federal income tax liabilities, if Rowe is a citizen of Maine, she is a citizen of the United States. And, even citizenship is not a prerequisite for tax liability as the internal revenue laws apply not only to citizens, but also to residents. See, e.g., Treas. Reg. § 1.1-1(a)(1)" the code imposes an income tax on the income of every individual who is a citizen or resident of the United States." See Dennis v. United States, 660 F.Supp. 870, 875 (C.D. Ill 1987) (challenge to taxing authority of the United States is "fallacious," as it is "well established" that it extends to all residents and citizens, citing § 1.1-1(a)(1). (Mot. Dismiss at 6-7) (footnote omitted)."

CA 2:

Estate of Petschek v. C.I.R., 738 F.2d 67, 69 (CA2 1984): "In the period prior to the abandonment of citizenship, the individual is taxed as a non-resident citizen. (cite omitted). Generally, a non-resident United States citizen is taxed on his worldwide income. Treas. Reg. § 1.1-1(b), 26 CFR § 1.1-1(b) (1983); Cook v. Tait, 265 US 47, 68 L.Ed. 895, 44 S.Ct. 444 (1924)."

CA 3:

US v. Siceloff, 451 Fed.Appx. 183, 185 (CA3 2011): "To start, Siceloff is clearly obligated to pay taxes as a citizen of the United States. See 26 CFR § 1.1-1(b) ("[A]ll citizens of the United States, wherever resident, income taxes imposed by the Code are liable to the income taxes imposed by the Code . . .")."

CA 3 District Court:

US v. Lesonik, #12-65 Erie (US Dist. Court of W. Dist. of Pennsylvania Oct. 2, 2012) at fn.1: "We note, parenthetically, that 26 USC § 1(a) imposes an income tax upon the income of "every" United State citizen and that, pursuant to § 1(a), 26 CFR § 1.1(b) provides that "all citizens of the United States are liable to the income taxes imposed by the Code . . ."

CA 4:

CA 4 (district court):

US. v. Darland, 2003-1 US Tax Cases (CCH) P50, 437; 91 A.F.T.R.2d (RIA) 2037 (March 26, 2003, US Dist. Court of Maryland): "The source rules of Sections 861-865 do not, as Defendant argues, "exclude from U.S. taxation income earned by US citizens from sources within the United States." Corcoran v. Commissioner of Internal Revenue, T.C. Memo 2002-18, 2002 WL 71029 (US Tax Court 2002), aff'd, 50 Fed.Appx. 738 (CA9 2002). In fact, 26 USC "imposes an income tax on the income of every individual who is a citizen or resident of the United States," and Section 61 defines "gross income" as "all income from whatever source derived," and includes Defendant's business income, pensions, and annuities. See 26 USC § 61(a); 26 CFR § 1.1-1(b)."

CA 5:

Thomason v. Commissioner of Internal Revenue, 401 Fed.Appx. 921, 923: 106 A.F.T.R.2d (RIA) 7049 (CA5 11/15/2010); "Thomason's argument, a variant of the US Sources argument" or "861 argument," has been universally discredited. [See] United States v. Bell, 414 F.3d 474, 475-76 (CA3 2005) (per curiam); see also United States v. Clayton, 506 F.3d 405, 412 (CA5 2007). "In general, all citizens of the United States . . . are liable to the income taxes imposed by the Code whether the income is received from sources within or without the United States." [See] Rayner v. Comm'r, 70 Fed.Appx. 739, 740 (CA5 2003) (unpublished) (quoting Treas. Reg. § 1.1-1(b) (2003) (internal quotation marks omitted)."

Rayner v. Commissioner of Internal Revenue, 70 Fed.Appx. 739, 740; 92 A.F.T.R.2d (RIA) 5151 (CA5 2003): "In general, all citizens of the United States are liable to the income taxes imposed by the Code whether the income is received from sources within or without the United States." (Fn7 which says, "Treas. Reg. § 1.1-1(b) (2003).").

CA 6:

Van Manen v. United States, 73 A.F.T.R.2d (RIA) 2033 (CA6 1994); "Third, Van Manens' jurisdictional argument is unavailing. It is a well established principle that the taxing power of the United States of America extends to every individual who is a citizen or resident of this nation. 26 CFR § 1.1-1(a)(1); Ponsford v. US, 771 F.2d 1305, 1307 (CA9 1985); Dennis v. US, 660 F.Supp. 870, 875 (C.D. Ill. 1987); Templeton v. IRS, 65O F.Supp. 202, 204-05 (N.D. Ind. 198S), aff'd 808 F.2d 838 (CA7 1986). Moreover, the "jurisdictional" argument has been consistently rejected by the courts. See Dennis, 660 F.Supp. at 875."

Cinelli v. Commissioner of Internal Revenue, 502 F.2d 695, 697; 34 A.F.T.R.2d (RIA) 5780 (CA6 1974); "The United States taxes all income of its citizens, whether earned here or abroad. Treas. Reg. § 1.1-1(b) (1956); Cook v. Tait, 265 US 47, 68 L.Ed 895, 44 S.Ct. 444 (1924)."

CA 6 (district court):

US v. Grooters, 86 A.F.T.R.2d (RIA) 6930 (#1:99-cv-488 W.D. Mich. Oct. 27, 2000): "As to whether the United States has jurisdiction to impose income taxes on the Grooters, 26 USC § 1 "imposes an income tax on the income of every individual who is a citizen or resident of the United States and, to the extent provided by section 871(b) or 877(b), on the income of a nonresident alien individual." 26 CFR § 1.1-1(a)."

CA 7:

US v. Vallone, 110 A.F.T.R.2d (RIA) 6110 (CA7 9/28/2012): "Vallone wrote a letter to the IRS in which he made a variety of baseless claims, including the assertions that he enjoyed certain rights unique to a "sovereign citizen" born in the United States; that he was neither a citizen nor resident of the United States as those terms are used in the Fourteenth Amendment or 26 CFR § 1.1-1(a)-(c), the IRS regulation identifying those persons who are subject to income tax by the United States[.]"

CA 8:

US v. Langrehr, 20 Fed.Appx. 587, BB A.F.T.R.2d (RIA) 6348 (CAB 2001): "The district court had jurisdiction because the Langrehrs conceded they were domiciled in Nebraska and the federal income tax applies to residents as well as citizens. See 26 CFR § 1.1-1(a); United States v. Jagim, 978 F.2d 1032 (CA8 1992), cert.den. 508 US 952 (1993)."

Daggett v. US, #4:CV-91-3087 (US Dist. Court of Nebraska (9/6/91): "Section 1 of the [Internal Revenue] Code imposes an income tax on the income of every individual who is a citizen or resident of the United States. 26 CFR § 1.1-1(a) (1990)."

CA 9:

Bates v. Commissioner of Internal Revenue, 436 Fed.Appx. 790, 107 A.F.T.R.2d (RIA) 2440 (CA9 6/7/2011): "The contention that the Bateses were not subject to federal income taxes is frivolous. See United States v. Nelson, (In re Becraft), 885 F.2d 547, 548 (CA9 1989) (order); Treas. Reg. § 1.1-1."

Arnstein v. US, 73 A.F.T.R.2d (RIA) 1815 (CA9 1994): "Arnstein argues that his petition was not an action for a refund of taxes because he is not subject to the Internal Revenue Code, and, therefore, the money seized from him was not taxes. This argument lacks merit. (See 26 USC § 1; 26 CFR § 1.1-1(a)(1) ("Section 1 of the Code imposes an income tax on the income of every individual who is a citizen or resident of the United States")."

Rintoul v. Commissioner of Internal Revenue, 73 A.F.T.R.2d (RIA) 466 (CA9 1/12/1994): "The internal revenue Code defines "taxpayer" as "any person subject to any internal revenue tax." 26 USC § 7701(a)(14). Every individual who is a citizen or resident of the United States is subject to income taxation. 26 USC § 1; Treas. Reg. § 1.1-1(a)(1)."

Pekrul v. Commissioner of Internal Revenue, 993 F.2d 884 (CA9 1993): "They claim instead that they are nonresident aliens whose income is not taxable. As did the Tax Court, we reject this frivolous argument because the Pukruls clearly are "taxpayers" whose wages are subject to the federal income tax. See US Const. amend. XVI; 26 USC § 1(c); Treas. Reg. § 1.1-1[.]"

Grammatico v. Commissioner of Internal Revenue, 988 F.2d 119 (CA9 1993): "First, the Grammaticos are "taxpayers" whose wages are subject to federal income tax. See US Const. amend XVI; 26 USC § 1(c); Treas. Reg. 1.1-1[.]"

Smith v. Commissioner of Internal Revenue, 978 F.2d 716 (CA9 1992): "First, the Smiths are "taxpayers" whose wages are subject to federal income tax. See US Const. amend XVI; 26 USC § 1(c); Treas. Reg. 1.1-1[.]"

Sharon v. Commissioner of Internal Revenue, 952 F.2d 1400 (CA9 1/15/1991): "First, Sharon's wages are not exempt from federal income tax. See US Const. amend. XVI (granting Congress authority to collect income tax); 26 USC § 1(c) (individual citizens are subject to federal income tax); Treas. Reg. § 1.1-1 "section 1 of the Code imposes [a federal] income tax on every individual who is a citizen or resident of the United States"[.]"

Brayton v. Commissioner of Internal Revenue, 923 F.2d 861 (CA9 1991): "Every individual United States citizen is subject to income taxation. I.R.C. § 1; 26 CFR § 1.1-1(a)(1)[.]"

Despain v. United States, 921 F.2d 279 (CA9 1990): "The CIR, however, is statutorily authorized to impose an income tax on individuals, such as Despain, who are United States citizens. See 26 USC § 1(c) (income tax on unmarried individuals); Treas. Reg. § 1.1-1 ("section 1 of the Code imposes an income tax on the income of every individual who is a citizen or resident of the United States"); Treas. Reg. § 1.6012-1(a)(1)(i) ("an income tax return must be filed by every individual [with gross income above a certain minimum level who is a] citizen of the United States whether residing at home or abroad")[.]"

US v. White, 921 F.2d 282 (CA9 12/20/1990): "The IRS is statutorily authorized to impose an income tax on United States citizens who reside in the United States and whose income is derived from domestic sources. See 26 USC § 1(c) (section 1(c) of the Code imposes an income tax on unmarried individuals); Treas. Reg. § 1.1-1 ("section 1 of the Code imposes an income tax on the income of every individual who is a citizen of the United States")[.]"

CA 10:

Wheeler v. Commissioner of Internal Revenue, 528 F.3d 773, 776-77 (CA10 1/10/2008): "The very first section of the Internal Revenue Code, 26 USC § 1, imposes an income tax on the taxable income of every citizen or resident of the United States. See 26 USC § 1; 26 CFR § 1.1-1(a)(1)."

Gallegos v. Commissioner of Internal Revenue, 150 Fed.Appx. 846, 847-48 (CA10 2005): "All citizens of the United are liable for income taxes, and every person born in is a citizen of the United States. 26 CFR § 1.1-1(a), (b), and (c)."

Cox v. Commissioner of Internal Revenue, 99 F.3d 1149 (CA10 1996): "All citizens of the United States are liable for income taxes and every person born in the United States is a citizen of the United States. See 26 CFR § 1.1-1(b), (c)[.]"

Benson v. US, 70 F.3d 123 (CA10 1995): "It is well settled that Mr. Ambort, a United States citizen born in California and living in the United States, is subject to the tax laws. See 26 CFR 1.1-1(b), (c)[.]"

CA 10 Dist. Court:

US v. Smith, 110 A.F.T.R.2d (RIA) 5325 (US Dist. Court New Mexico #12-mc-18-JCH July 13, 2012) at fn.4: "The very first section of the Internal Revenue Code, 26 USC § 1, imposes an income tax on the taxable income of every citizen or resident of the United States. See 26 USC § 1; 26 CFR § 1.1-1(a)(1)."

US v. Gonzales, (#89-F-1740 Dist. Colorado 2/6/1991) at fn.2: "All United States citizens and resident aliens must pay federal income tax. 26 CFR § 1.1-1(b)[.]"

CA 11:

Ahmed v. C.I.R., 498 Fed.Appx. 919, 921, 110 A.F.T.R.2d (RIA) 6721 (11/21/2012): "The Sixteenth Amendment to the U.S. Constitution provides that "Congress shall have the power to lay and collect taxes on incomes, from whatever source derived." U.S. Const. Amdn. XVI. The Internal Revenue Code ("IRC") imposes a tax on the taxable income of every individual who is a citizen or resident of the United States, with some exceptions not applicable here. 26 USC § 1(a)-(d); 26 CFR § 1.1-l(a)."

Langille v. Commissioner of Internal Revenue, 447 Fed.Appx. 130, 132; 108 A.F.T.R.2d (RIA) 7254 (CAll 11/22/2011): "The Sixteenth Amendment to the U.S. Constitution provides that "Congress shall have the power to lay and collect taxes on incomes, from whatever source derived." U.S. Const. Amdt. XVI. The Internal Revenue Code ("IRC") imposes a tax on the taxable income of every individual who is a citizen or resident of the United States, and estates and trusts, with some exceptions not applicable here. 26 USC § 1(a)-(e); 26 CFR § 1.1-1(a)."

Rotte v. Commissioner of Internal Revenue, 216 Fed.Appx. 826, 827; 99 A.F.T.R.2d (RIA) 615 (CAll 2007); "The Sixteenth Amendment to the U.S. Constitution provides, in part, that "Congress shall have the power to lay and collect taxes on incomes, from whatever source derived... U.S. Const. Amdt. XVI. The Internal Revenue Code ("IRC") imposes a tax on the taxable income of every individual who is a citizen or resident of the United States, with some exceptions not applicable to Rotte. 26 USC § 1(a)-(d); 26 CFR § 1.1-1(a)."

Wright v. US, Internal Revenue Service, 94 A.F.T.R.2d (RIA) 6247 (M.D. Georgia, Columbus 2004): "[T]oday's Internal Revenue Code still "imposes an income tax on the income of every individual who is a citizen or resident of the United States." 26 CFR § 1.1-1 (2004)."

Hovind v. US, #3:97-cv-l90-RV (3/25/1998 N.D. of Fla. Pensacola Division): "However, under our federal system, all citizens of the United States are liable for income taxes and every person born in the United States is a citizen of the United States, regardless of state citizenship. See 26 CFR 1.1-l(b), (c)[.]"

CA D.C. :

Haver v. Commissioner of Internal Revenue, 444 F.3d 656 (CA D.C. 2006): "Normally, U.S. citizens are subject to taxation on all of their income no matter where they live, see 26 CFR § 1.1-1(a)-(b) (2005) (interpreting 26 USC § 1 (2000)), with possible offsets for foreign tax credits."

Jombo v. Commissioner of Internal Revenue, 398 F.3d 661, 665 (CA D.C. 2004): "All resident alien individuals are liable to the income taxes imposed by the Code whether the income is received from sources within or without the United States," 26 CFR § 1.1-1(b), and individuals qualify as resident aliens if the permanent residency status has not been revoked[.]"

Kappus v. Commissioner of Internal Revenue, 337 F.3d 1053, 1055 (CA D.C. 8/8/2003): "All American citizens are subject to U.S. taxes, regardless of where they live or earn their income. See 26 CFR § 1.1-1(b)[.]"

U.S. Supreme Court:

Demore v. Kim, 538 US 510, 155 L.Ed.2d 724, 751, 123 S.Ct. 1708 (2003): "Unlike temporary, nonimmigrant aliens, who are generally taxed only on income from domestic sources or connected with a domestic business, 26 USC § 872, LPRs, like citizens, are taxed on their worldwide income, 26 CFR § 1.1-1(b), 1.871-l(a), 1.871-2(b) (2002)."

*End citations of Treasury Regulation 1.1-1 decisions.

26 USC § 7701 Definitions.

(a) When used in this title, where not otherwise distinctly expressed or manifestly incompatible with the intent thereof-

(9) United States.-The term "United States" when used in a geographical sense includes only the States and the District of Columbia.

(10) State.-The term "State" shall be construed to include the District of Columbia, where such construction is necessary to carry out provisions of this title.

Note: Under this definition, Alaska and Hawaii were removed from applicability upon receiving freely associated compact state status (See P.L. 86-624, § 18(j); P.L. 86-70, § 22(a)). The fifty freely associated compact states are "countries" (See 28 USC § 297(b)).U.S. Constitution, Amdt. 16, February 25, 1913. "The Congress shall have power to lay and collect taxes on incomes, from whatever source derived, without apportionment among the several States and without regard to any census or enumeration."

Conclusion: The statute, Tax Code § 1, makes no mention of anyone's citizenship, but rather alludes only to "individuals," who could very well be the "individual" who has the citizenship referenced in Social Security chapters 2 and 21; that's not an American. Were it not for Treasury Regulation 1.1-1 Americans could not be said to be the subject of any of the Tax Code's provisions. The case law serves well to illustrate that the regulation does all the heavy lifting.

§§§§§§§§§§§§§§§§§§§§§§§§§§§§§§§§§§§§§§§

3. All property is an "amount paid":

1.

Tax Code § 83 applies to any and all compensation for personal

services actually performed: YouTube

- https://youtu.be/YWZ10bpVmp0

Cohn v. C.I.R., 73 USTC 443, 446 (1979): "Petitioners rest their entire case on the proposition that Elovich and Cohn and/or Mega were "independent contractors" and not employees of the Integrated and that, therefore, section 83 does not apply to the acquisition of the shares from Integrated. They rely on the legislative history surrounding the statute to support their proposition that section 83 was intended to apply only to restricted stock transferred to employees. Respondent contends that the words "any person" in section 83(a) encompass independent contractors as well as employees. We agree with Respondent. . . . We reject petitioner's argument. While restricted stock plans involving employers and employees may have been the primary impetus behind the enactment of section 83, the language of the section covers the transfer of any property transferred in connection with the performance of services "to any person other than the person for whom the services are performed." (Emphasis added.) The legislative history makes clear that Congress was aware that the statute's coverage extended beyond restricted stock plans for employees. H.Rept. 91-413 (Part 1) (1969), 1969-3 C.B. 200, 255; S.Rept. 91-552 (1969), 1969-3 C.B. 423, 501. The regulations state that that section 83 applies to employees and independent contractors (sec. 1.83-1(a), Income Tax Regs.). There is no question but that, under the foregoing circumstances, these regulations are not "unreasonably and plainly inconsistent with the revenue statutes." Consequently, they are sustained. (cites omitted)"

Pledger v. C.I.R., 641 F.2d 287, 293 (CA5 1981): "The taxing scheme imposed by Congress more accurately reflects what taxpayer received as compensation than a scheme that taxes the taxpayer on merely a portion of the compensation."

Alves v. C.I.R., 734 F.2d 478, 481 (CA9 1984): "The plain language of section 83(a) belies Alve's argument. Section 83(a) applies to all property transferred in connection with the performance of services. No reference is made to the term "compensation." Nor is there any statutory requirement that property have a fair market value in excess of the amount paid at the time of transfer. Indeed, if Congress had intended section 83(a) to apply solely to restricted stock used to compensate its employees, it could have used much narrower language. Indeed, Congress made section 83(a) applicable to all restricted "property," not just stock; to property transferred to "any person," not just to employees; and to property transferred "in connection with . . . services," not just compensation for employment. See Cohn v. Commissioner, 73 USTC 443, 446-47 (1979)."

Robinson v. C.I.R., 82 USTC 444, 459 (1984): "The legislative history of section 83 does not require the conclusion that the statute should be applied to tax-avoidance techniques only. To the contrary, the House and Senate reports specifically delineate transactions and transfers to which section 83 was not to apply and do not exclude from its purview contractual provisions that were not tax motivated."

Pagel, Inc. v. Commissioner, 91 TC 200, 204-05 (Tax Court #34122-85, 1988): "We shall begin our analysis with an exegesis of the general provisions of section 83. We then shall examine those provisions in conjunction with the facts of the instant case so that we may decide whether respondent adequately notified petitioner of the issue of the applicability of section 83. Section 83(a) generally provides that where property is transferred in connection with the performance of past, present, or future services, the excess of the fair market 205*205 value of the property over the amount paid for the property is includable as compensation in the gross income of the taxpayer who performed the services. Bagley v. Commissioner, 85 T.C. 663, 669 (1985), affd. per curiam 806 F.2d 169 (8th Cir. 1986). Section 83 does not apply only to employees of the transferor of the property; rather, it is applicable to any person other than the one for whom the services were performed, including independent contractors of the transferor. Cohn v. Commissioner, 73 T.C. 443, 446 (1979). (footnote ommited). Thus, even though petitioner's relationship to Immuno was that of an independent contractor rather than an employee, section 83 may apply to the receipt or disposition of the warrant by petitioner if the other requirements of that section are met."

MacNaughton v. C.I.R., 888 F.2d 418, 421 (CA6 1989): "The Alves court stated that the plain language of section 83 belied this argument because the "statute applied to all property transferred in connection with the performance of services" and because no reference is made to the term "compensation." Id. The court further concluded in Alves that "if Congress had intended section 83(a) to apply solely to restricted stock used to compensate employees, it could have used much narrower language." Id. at 481-82. Upon consideration, we agree with the interpretation advanced by the Alves court and, therefore, join the Ninth Circuit in holding that section 83 is not limited to stock transfers which are compensatory in nature."

*Concurring with Cohn, Alves, see Centel Communications Co. v. CIR, 920 F.2d 1335, 1342 (CA7 1990).

Klingler Electric Co. v. C.I.R., 776 F.Supp. 1158, 1164 at [1] (S.D.Miss. 1991): "Section 83(a) applies to all property transferred in connection with the performance of services."

Montelepre Systemed, Inc. v. C.I.R., 956 F.2d 496, 498 at [1] (CA5 1992): "Section 83(a) explains how property received in exchange for services is taxed."

Gudmundsson v. US, 634 F.3d 212 (CA2 2011): "At the heart of this case is I.R.C. § 83, which governs the taxation of property transferred in connection with the performance of services."

"Section 83 provides for the determination of the amount to be included in gross income and the timing of the inclusion when property is transferred to an employee or independent contractor in connection with the performance of services." (See IRS Revenue Ruling 2007-19, IRS' Office of Associate Chief Counsel (Procedure & Administration), Administrative Provisions and Judicial Practice Division, 2007)."

IRS Officer, Sue Besson, 20 yrs. on the job who performed over 500 investigations, on the stand in the tax evasion trial of Raymond Gebauer, August of 2007: "I am unfamiliar with § 83."

The Supreme Court says:

"[W]e have referred to the Court of Appeals when enquiring whether a right was "clearly established." "

See United States v. Lanier, 520 US 259, 269, 137 L.Ed.2d 432, 117 S.Ct. 1219 (1997) (citing Mitchell v. Forsyth, 427 US 511, 533, 86 L.Ed.2d 411, 105 S.Ct. 2806 (1985); Davis v. Scherer, 468 US 183, 191-92, 82 L.Ed.2d. 139, 104 S.Ct. 3012 (1984); Elder v. Halloway, 510 US 510, 516, 127 L.Ed.2d 344, 114 S.Ct. 1019 (1994) (treating Court of Appeals decisions as "relevant authority" that must be considered as part of qualified immunity enquiry)).

"[E]ach section of the Internal Revenue Code is not a self contained whole, but rather a building block of a complex, interrelated statute." (See Hartman v. Comm'r IRS, 65 TC 542, 545 (1975)).

Because § 83 is universally applicable to any and all compensation, I have no choice but to comply with it when I calculate my income tax liability. More importantly, the IRS has the same obligation.

******************************

Authorities relative to the interpretation of Tax Code § 83(a):

2.

Labor is property, and its value is determined through

the terms of an arm's length transaction:

Labor is the most sacred property and inviolable right of man.

"The authorities we have cited show that labor is a doom, and if submitted to with fidelity, secures a blessing to the human family. The obligation to labor being imperious, confers a right to labor, which right is property; and it cannot be withdrawn or destroyed by arbitrary legislation without a violation of natural right. This right is a social right, and constitutions have been made to secure it from invasion. No State of the American Union can deprive a man of his title by arbitrary edict; and arbitrary institutions to limit, depress, impair or to take away this right, cannot be favored or maintained. ...And it is of profound regret to me that its validity is recognized by a majority of this Court, for by it the right to free labor, one of the most sacred and imprescriptible rights of man, is violated." Slaughterhouse, 16 Wall. 36-130 (1872). "Among these inalienable rights, as proclaimed in that document [Dec. of Independence.], is the right of men to pursue their happiness, by which is meant the right to pursue any lawful business or vocation, in any manner not inconsistent with the equal rights of others, which may increase their prosperity or develop their faculties, so as to give their highest enjoyment.

"The common business and callings of life, the ordinary trades and pursuits, which are innocuous in themselves, and have been followed in all communities from time immemorial, must, therefore, be free in this country to all alike upon the same conditions. The right to pursue them, without let or hindrance, except that which is applied to all persons of the same age, sex, condition, is a distinguished privilege of citizens of the United States, and an essential element of that freedom which they claim as their birthright.

"It has been well said that, the property which every man has is his own labor, as it is the original foundation of all other property, so it is the most sacred and inviolable. The patrimony of the poor man lies in the strength and dexterity of his own hands, and to hinder his employing this strength and dexterity in what manner he thinks proper, without injury to his neighbor, is a plain violation of the most sacred property."

See

Butcher's Union Co. v. Crescent City Co., 111 U.S. 746 (1883).

And -

"The fair market value is the price at which the property would change hands between a wiling buyer and a willing seller, neither being under any compulsion to buy or sell and both having reasonable knowledge of the relevant facts." Treas.Reg. §20.2031-1(b). The willing buyer-willing seller test of fair market value is nearly as old as the federal income, estate, and gift taxes themselves, and is not challenged here."

" . . .The 'willing buyer' is the fully informed person who agrees to buy . . . at the redemption price. . . . It is a market made up of informed buyers and informed sellers, all dealing at arm's length."

See U.S. v. Cartwright, 411 U.S. 546, 551 (1973). And -

"Fair market value is that "price which would probably agreed upon by a seller willing, but under no compulsion, to sell, and a buyer willing, but under no compulsion, to buy, where both have reasonable knowledge of the facts."

Black's Law Dictionary, 6th Edition, "Arm's length transaction." Said of a transaction negotiated between unrelated parties, each acting in his or her own self interest; the basis for a fair market value determination. A transaction in good faith in the ordinary course of business by parties with independent interests . . . The standard under which unrelated parties, each acting in his or her own best interest, would carry out a particular transaction.

From my employer, from my customer, from my client, who are unrelated parties who pay me in arm's length transactions for my personal services, I receive fees, commissions, tips, salaries, vacation pay, sick pay, medical benefits, dental benefits, company car, a pension, all things paid in connection with the performance of my services under the contract governing my obligations to the one purchasing my services.

******************************

3.

When the law says "any" or "any

property" it's construed as all inclusive:

As used in statute and regulation, the terms "any" or "any property" are to be construed as all inclusive until express statutory exceptions can be cited to support a contention that such terms are not all inclusive. (See U.S. v. Monsanto, 491 U.S. 600, 607-611 and (syllabus) (1989); United States v. Alvarez-Sanchez, 511 U.S. 350, 357 (1994); U.S. v. Gonzales, 520 U.S. 1, 4-6 (1997); Department of Housing and Urban Renewal v. Rucker, 535 U.S. 125, 130-31 (2002) citing Gonzalez and Monsanto (ALL FOUR decisions in .pdf format here)).

1989 - Monsanto: Heroin manufacturer Monsanto argues that he should be allowed to keep enough money for attorney's fees, but the DOJ argues successfully that "any property" is all inclusive and therefore means the U.S. can seize any and all property unless Monsanto can point to a specific exclusion of attorney's fees under the law. DOJ can seize everything owned by defendant.

1994 - Alvarez: U.S. argues successfully that, because statute expressly provides for an exception to "any," that it is not all inclusive, that a "delay" should not preclude a criminal defendant's confession or statement to state police from being used as evidence in federal case commenced thereafter. DOJ can use confession sought to be suppressed by criminal defendant.

1997 - Gonzales: U.S. argues successfully that "any" in sentencing laws is all inclusive and therefore prevents the defendants from serving federal time concurrently with other sentences, argues for more jail time and gets it. More jail time for convict.

2002 - Rucker (citing Monsanto and Gonzales): U.S. argues successfully that "innocent owner" defense unavailable to co-tenant of low income housing who, although innocent, was subject to the statute's eviction of an all inclusive "any tenant" of a leased unit where prohibited activity had taken place. U.S. can evict the innocent tenant of low income housing unit which is scene of prohibited behavior.

2008 - See Ali v. Federal Bureau of Prisons, 128 S. Ct. 831, 835-36 (2008): "Petitioner's argument is inconsistent with the statute's language.(fn.3 omitted) The phrase "any other law enforcement officer" suggests a broad meaning. Ibid. (emphasis added). We have previously noted that "[r]ead naturally, the word `any' has [836] an expansive meaning, that is, `one or some indiscriminately of whatever kind.'" United States v. Gonzales, 520 U.S. 1, 5, 117 S.Ct. 1032, 137 L.Ed.2d 132 (1997) (quoting Webster's Third New International Dictionary 97 (1976)). In Gonzales, we considered a provision that imposed an additional sentence for firearms used in federal drug trafficking crimes and provided that such additional sentence shall not be concurrent with "any other term of imprisonment." 520 U.S., at 4, 117 S.Ct. 1032 (quoting 18 U.S.C. § 924(c)(1) (1994 ed.) (emphasis deleted)). Notwithstanding the subsection's initial reference to federal drug trafficking crimes, we held that the expansive word "any" and the absence of restrictive language left "no basis in the text for limiting" the phrase "any other term of imprisonment" to federal sentences. 520 U.S., at 5, 117 S.Ct. 1032. Similarly, in Harrison v. PPG Industries, Inc., 446 U.S. 578, 100 S.Ct. 1889, 64 L.Ed.2d 525 (1980), the Court considered the phrase "any other final action" in amendments to the Clean Air Act. The Court explained that the amendments expanded a list of Environmental Protection Agency Administrator actions by adding two categories of actions: actions under a specifically enumerated statutory provision, and "any other final action" under the Clean Air Act. Id., at 584, 100 S.Ct. 1889 (emphasis deleted). Focusing on Congress' choice of the word "any," the Court "discern[ed] no uncertainty in the meaning of the phrase, `any other final action,'" and emphasized that the statute's "expansive language offer[ed] no indication whatever that Congress intended" to limit the phrase to final actions similar to those in the specifically enumerated sections. Id., at 588-589, 100 S.Ct. 1889."

And from Monsanto, Id.:

"Section 853's language is plain and unambiguous. Congress could not have chosen stronger words to express its intent that forfeiture be mandatory than § 853(a)'s language that upon conviction a person "shall forfeit . . . any property" and that the sentencing court "shall order" a forfeiture. Likewise, the statute provides a broad definition of property which does not even hint at the idea that assets used for attorney's fees are not included. Every Court of Appeals that has finally passed on this argument has agreed with this view. Neither the Act's legislative history nor legislators' post-enactment statements support respondent's argument that an exception should be created because the statute does not expressly include property to be used for attorney's fees, or because Congress simply did not consider the prospect that forfeiture would reach such property. . . . Moreover, respondent's admonition that courts should construe statutes to avoid decision as to their constitutionality is not license for the judiciary to rewrite statutory language. Pp. 606-611."

"In determining the scope of a statute, we look first to its language." United States v. Turkette, 452 U.S. 576, 580 (1981). In the case before us, the language of § 853 is plain and unambiguous: all assets falling within its scope are to be forfeited upon conviction, with no exception existing for the assets used to pay attorney's fees -- or anything else, for that matter.

As observed above, § 853(a) provides that a person convicted of the offenses charged in respondent's indictment "shall forfeit . . . any property" that was derived from the commission of these offenses. After setting out this rule, § 853(a) repeats later in its text that upon conviction a sentencing court "shall order" forfeiture of all property described in § 853(a). Congress could not have chosen stronger words to express its intent that forfeiture be mandatory in cases where the statute applied, or broader words to define the scope of what was to be forfeited. Likewise, the statute provides a broad definition of "property" when describing what types of assets are within the section's scope: "real property . . . tangible and intangible personal property, including rights, privileges, interests, claims, and securities." 21 U.S.C. § 853(b) (1982 ed., Supp.V). Nothing in this all-inclusive listing even hints at the idea that assets to be used to pay an attorney are not "property" within the statute's meaning.

Nor are we alone in concluding that the statute is unambiguous in failing to exclude assets that could be used to pay an attorney from its definition of forfeitable property. This argument, advanced by respondent here, see Brief for Respondent 12-19, has been unanimously rejected by every Court of Appeals that has finally passed on it, as it was by the Second Circuit panel below, see 836 F.2d at 78-80; id. at 85-86 (Oakes, J., dissenting); even the judges who concurred on statutory grounds in the en banc decision did not accept this position, see 852 F.2d at 1405-1410 (Winter, J., concurring). We note also that the Brief for American Bar Association as Amicus Curiae 6, frankly admits that the statute "on [its] face, broadly cover[s] all property derived from alleged criminal activity and contain[s] no specific exemption for property used to pay bona fide attorneys' fees."